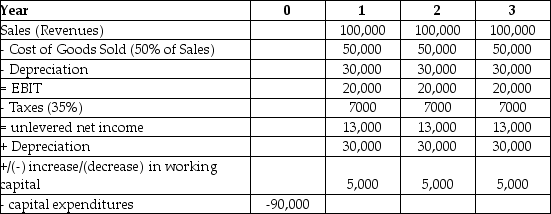

Epiphany Industries is considering a new capital budgeting project that will last for three years. Epiphany plans on using a cost of capital of 12% to evaluate this project. Based on extensive research, it has prepared the following incremental cash flow projects:

The free cash flow for the first year of Epiphany's project is closest to ________.

A) $45,600

B) $28,500

C) $38,000

D) $53,200

Correct Answer:

Verified

Q27: Which of the following costs would you

Q44: Bubba Ho-Tep Company reported net income of

Q45: Your firm is considering building a new

Q46: You are considering adding a microbrewery onto

Q48: Shepard Industries is evaluating a proposal to

Q50: Shepard Industries is evaluating a proposal to

Q52: The Sisyphean Company is considering a new

Q56: A firm is considering investing in a

Q57: The Sisyphean Corporation is considering investing in

Q59: Luther Industries has outstanding tax loss carryforwards

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents