Multiple Choice

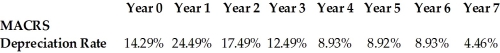

A textile company invests $10 million in an open-end spinning machine. This was depreciated using the seven-year MACRS schedule shown above. If the company sold it immediately after the end of year 3 for $7 million, what would be the after-tax cash flow from the sale of this asset, given a tax rate of 40%?

A textile company invests $10 million in an open-end spinning machine. This was depreciated using the seven-year MACRS schedule shown above. If the company sold it immediately after the end of year 3 for $7 million, what would be the after-tax cash flow from the sale of this asset, given a tax rate of 40%?

A) $1,550,400

B) $3,124,000

C) $3,876,000

D) $5,449,600

Correct Answer:

Verified

Related Questions

Q28: How are the taxes paid under MACRS