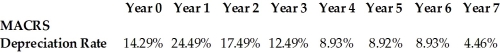

Massive Amusements, an owner of theme parks, invests $65 million to build a roller coaster. This can be depreciated using the MACRS schedule shown above. How much less is the depreciation tax shield for year 4 under MACRS depreciation than under 7-year, straight-line depreciation, if the tax rate is 35%?

Massive Amusements, an owner of theme parks, invests $65 million to build a roller coaster. This can be depreciated using the MACRS schedule shown above. How much less is the depreciation tax shield for year 4 under MACRS depreciation than under 7-year, straight-line depreciation, if the tax rate is 35%?

A) $974,680

B) $1,218,350

C) $2,193,030

D) $6,091,750

Correct Answer:

Verified

Q61: An announcement by the government that they

Q63: A company spends $20 million researching whether

Q65: Firms should use the most accelerated depreciation

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents