Multiple Choice

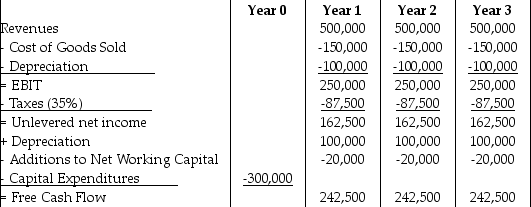

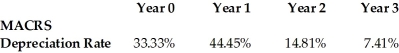

Visby Rides, a livery car company, is considering buying some new luxury cars. After extensive research, they come up with the above estimates of free cash flow from this project. The depreciation schedule shown is for three-year, straight-line depreciation. By how much would the net present value (NPV) of this project be increased, if the cars were depreciated by the MACRS schedule shown below given that the cost of capital is 10%?

A) $7266

B) $9082

C) $10,898

D) $22,705

Correct Answer:

Verified

Related Questions

Q28: How are the taxes paid under MACRS

Q68: What are the most difficult parts of