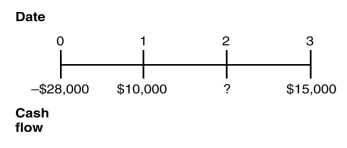

You are offered an investment opportunity that costs you $28,000, has a net present value (NPV) of $2278, lasts for three years, has interest rate of 10%, and produces the following cash flows:  The missing cash flow from year 2 is closest to ________.

The missing cash flow from year 2 is closest to ________.

A) $12,500

B) $12,000

C) $13,000

D) $10,000

Correct Answer:

Verified

Q23: The payback rule is based on the

Q25: Under what situation can the net present

Q27: A bakery is deciding whether to buy

Q28: Which of the following statements is FALSE?

A)

Q29: The Sisyphean Company is planning on investing

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents