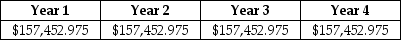

The Sisyphean Company is planning on investing in a new project. This will involve the purchase of some new machinery costing $400,000. The Sisyphean Company expects cash inflows from this project as detailed below:

The appropriate discount rate for this project is 15%. The internal rate of return (IRR) for this project is closest to ________.

A) 13%

B) 16%

C) 21%

D) 24%

Correct Answer:

Verified

Q33: The internal rate of return (IRR) rule

Q40: Consider the following two projects: Q41: Mary is in contract negotiations with a Q42: Use the information for the question(s) below.![]()

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents