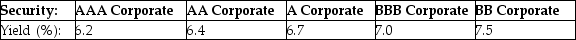

Consolidated Insurance wants to raise $35 million in order to build a new headquarters. The company will fund this by issuing 10-year bonds with a face value of $1,000 and a coupon rate of 6.3%, paid semiannually. The above table shows the yield to maturity for similar 10-year corporate bonds of different ratings. Which of the following is closest to how many more bonds Consolidated Insurance would have to sell to raise this money if their bonds received an A rating rather than an AA rating?

A) 937 bonds

B) 1093 bonds

C) 781 bonds

D) 625 bonds

Correct Answer:

Verified

Q81: What is the dirty price of a

Q82: Use the information for the question(s) below.

Q83: A firm issues two-year bonds with a

Q85: Use the information for the question(s) below.

Q86: Use the information for the question(s) below.

Q88: A company issues a ten-year $1,000 face

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents