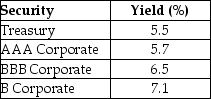

Consider the following yields to maturity on various one-year, zero-coupon securities:

The price (expressed as a percentage of the face value) of a one-year, zero-coupon corporate bond with a BBB rating is closest to ________.

A) 112.68

B) 131.46

C) 75.12

D) 93.90

Correct Answer:

Verified

Q61: A bond is currently trading below par.

Q65: Which of the following bonds will be

Q70: A bond will trade at a discount

Q71: Which of the following bonds is trading

Q76: What issues should one be careful of

Q84: A company issues a ten-year $1,000 face

Q87: A 20-year bond with a $1,000 face

Q90: Bonds with a high risk of default

Q93: A corporate bond which receives a BBB

Q98: Under what situation should the clean price,

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents