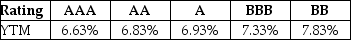

Luther Industries needs to raise $25 million to fund a new office complex. The company plans on issuing ten-year bonds with a face value of $1,000 and a coupon rate of 6.0% (annual payments) . The following table summarizes the YTM for similar ten-year corporate bonds of various credit ratings:

Assuming that Luther's bonds receive a AA rating, the price of the bonds will be closest to ________.

A) $1129

B) $941

C) $1318

D) $753

Correct Answer:

Verified

Q83: A firm issues two-year bonds with a

Q85: Use the information for the question(s) below.

Q89: Use the information for the question(s)below.

Luther Industries

Q95: The credit spread of a bond shrinks

Q96: A five-year bond with a $1,000 face

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents