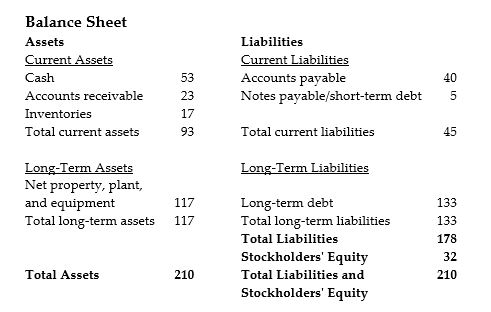

The above diagram shows a balance sheet for a certain company. All quantities shown are in millions of dollars. If the company has 5 million shares outstanding, and these shares are trading at a price of $6.39 per share, what does this tell you about how investors view this firm's book value?

The above diagram shows a balance sheet for a certain company. All quantities shown are in millions of dollars. If the company has 5 million shares outstanding, and these shares are trading at a price of $6.39 per share, what does this tell you about how investors view this firm's book value?

A) Investors consider that the firm's market value is worth very much less than its book value.

B) Investors consider that the firm's market value is worth less than its book value.

C) Investors consider that the firm's market value and its book value are roughly equivalent.

D) Investors consider that the firm's market value is worth more than its book value.

Correct Answer:

Verified

Q9: A 30-year mortgage loan is a:

A)long-term liability.

B)current

Q15: Accounts payable is a:

A)long-term liability.

B)current asset.

C)long-term asset.

D)current

Q20: Cash is a:

A)long-term asset.

B)current asset.

C)current liability.

D)long-term liability.

Q21: Which of the following statements regarding the

Q25: Which of the following statements regarding the

Q29: Luther Corporation

Consolidated Balance Sheet

December 31, 2006 and

Q30: What is a firm's gross profit?

A) the

Q31: Gross profit is calculated as _.

A) total

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents