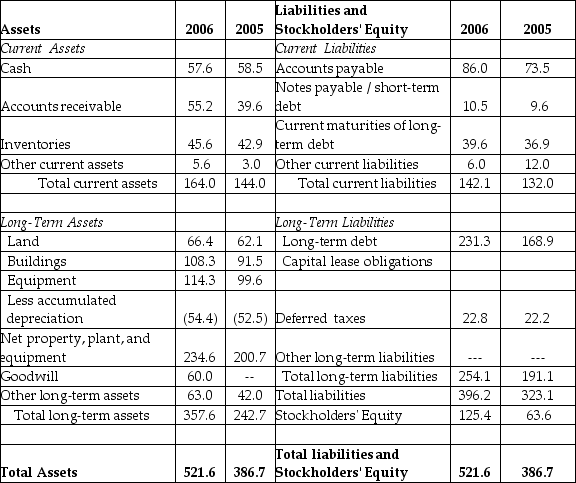

Luther Corporation

Consolidated Balance Sheet

December 31, 2006 and 2005 (in $ millions)

Refer to the balance sheet above. If in 2006 Luther has 10.2 million shares outstanding and these shares are trading at $16 per share, then using the market value of equity, the debt-equity ratio for Luther in 2006 is closest to ________.

A) 3.45

B) 1.72

C) 0.86

D) 2.41

Correct Answer:

Verified

Q42: The management of public companies is not

Q43: A software company acquires a smaller company

Q45: What is the need for the notes

Q48: In general, a successful firm will have

Q53: Use the table for the question(s) below.

AOS

Q55: Use the table for the question(s) below.

AOS

Q63: Luther Corporation

Consolidated Balance Sheet

December 31, 2006 and

Q64: Luther Corporation

Consolidated Balance Sheet

December 31, 2006 and

Q65: Luther Corporation

Consolidated Balance Sheet

December 31, 2006 and

Q66: A public company has a book value

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents