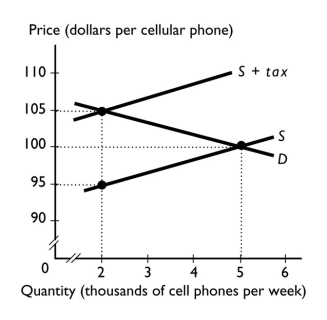

-The graph shows the market for cell phones.The government imposes a sales tax on cell phones at $10 a cell phone.The excess burden of the sales tax on cell phones is ________.

A) $20,000

B) $15,000

C) $35,000

D) $7,500

E) $30,000

Correct Answer:

Verified

Q86: _ tax rate equals _.

A) A marginal;

Q87: Taxes on corporate profit are a type

Q88: The buyer will pay the entire tax

Q89: Ann pays $3,850 in taxes on an

Q90: A sales tax creates a deadweight loss

Q92: The deadweight loss from a tax is

Q93: For the United States,which tax is the

Q94: The marginal tax rate is the

A) average

Q95: If a tax is placed on tires,then

i.the

Q96: The supply of oil is more elastic

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents