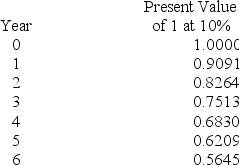

A company wishes to buy new equipment for $9,000. The equipment is expected to generate an additional $2,800 in cash inflows for six years. All cash flows occur at year-end. A bank will make a $9,000 loan to the company at a 10% interest rate so that the company can purchase the equipment. Use the table below to determine break-even time for this equipment:

A) Break-even time is between two and three years.

B) Break-even time is between three and four years.

C) Break-even time is between four and five years.

D) Break-even time is between five and six years.

E) This project will never break-even.

Correct Answer:

Verified

Q22: Capital budgeting decisions are generally based on:

A)

Q62: A minimum acceptable rate of return for

Q71: Restating future cash flows in terms of

Q72: Which of the following is an objective

Q74: Coffer Co. is analyzing two potential investments.

Q74: The calculation of the payback period for

Q79: Porter Co. is analyzing two potential investments.

Q79: A disadvantage of using the payback period

Q80: A project requires a $28,000 investment

Q97: The rate that yields a net present

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents