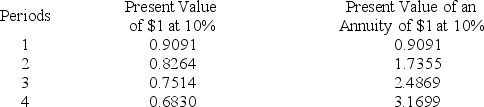

Poe Company is considering the purchase of new equipment costing $80,000. The projected net cash flows are $35,000 for the first two years and $30,000 for years three and four. The revenue is to be received at the end of each year. The machine has a useful life of 4 years and no salvage value. Poe requires a 10% return on its investments. The present value of $1 and present value of an annuity of $1 for different periods is presented below. Compute the net present value of the machine.

A) $(15,731) .

B) $(4,896) .

C) $15,731.

D) $4,896.

E) $23,775.

Correct Answer:

Verified

Q31: Capital budgeting decisions are risky because all

Q33: The process of analyzing alternative long-term investments

Q127: What is capital budgeting? Why are capital

Q131: In using a capital budgeting method that

Q133: Nestor Company is considering the purchase of

Q133: A postaudit is:

A)An evaluation of the effectiveness

Q146: Identify at least three reasons for managers

Q148: Briefly describe both the payback period method

Q160: How does the calculation of break-even time

Q188: The _ is computed by discounting the

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents