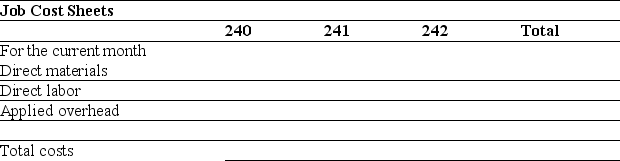

Drop Anchor takes special orders to manufacture sail boats for high-end customers. Prepare journal entries to record the transactions below and prepare job cost sheets for September.

a. Purchased raw materials on credit, $145,000.

b. Materials requisitions: Job 240, $48,000; Job 241, $36,000; Job 242, $42,000; indirect materials were $12,000.

c. Time tickets used to charge labor to jobs: Job 240, $40,000; Job 241, $30,000; Job 242, $35,000, indirect labor is $25,000.

d. The company incurred the following additional overhead costs: depreciation of factory building, $70,000; depreciation of factory equipment, $60,000; expired factory insurance, $10,000; utilities and maintenance cost of $20,000 were paid in cash.

e. Applied overhead to all three jobs. The predetermined overhead rate is 190% of direct labor cost.

f. Transferred jobs 240 and 242 to Finished Goods Inventory.

g. Sold job 240 for $300,000 for cash.

h. Closed the under- or over-applied overhead account balance.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q185: A company's ending inventory of finished goods

Q188: A company's job order costing system applies

Q192: A company's predetermined overhead rate is 130%

Q198: Selected information for Singh Corp. for the

Q202: A _ is a separate record maintained

Q204: Booth Manufacturing uses a job order costing

Q206: Overapplied overhead should be _ to the

Q208: When the actual overhead incurred during an

Q210: _, or customized production, produces products in

Q211: When indirect labor is recorded,_ is debited.

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents