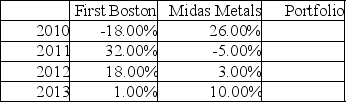

Returns on the stock of First Boston and Midas Metals for the years 2010-2013 are shown below.

a. Compute the average annual return for each stock and a portfolio consisting of 50% First Boston and 50% Midas.

b. Compute the standard deviation for each stock and the portfolio.

c. Are the stocks positively or negatively correlated and what is the effect on risk?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q23: Combining uncorrelated assets will

A)increase the overall risk

Q23: Standard deviation is a measure that indicates

Q25: In the real world, most of the

Q27: A negative beta means that on average

Q33: American investors have several alternatives available to

Q35: Explain the relationship between correlation, diversification, and

Q36: Over the long term, a portfolio consisting

Q37: The transaction costs of investing directly in

Q38: The risk of a portfolio consisting of

Q38: American depositary shares (ADS)are

A)shares of foreign companies

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents