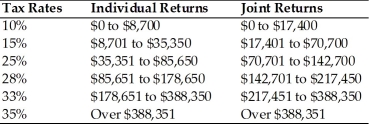

Table 1.4

Use the following tax rates and income brackets for 2012 to answer the following question(s) .

-Josh earned $82,500 in taxable income, all from wages and interest, and files an individual tax return. What is the amount of Josh's taxes for the year 2012? Round to the nearest dollar.

A) $13,750

B) $16,665

C) $18,425

D) $20,625

Correct Answer:

Verified

Q22: Bonds represent a lower level of risk

Q28: Bond investors lend their money for a

Q32: Bond interest and stock dividends are different

Q46: Which of the following represent investment goals?

I.

Q47: Table 1.4

Use the following tax rates and

Q52: Retirement plans, such as a 401(k), allow

Q54: To qualify for long-term capital gains rates,

Q55: Tax planning

A) guides investment activities to maximize

Q62: Discuss the relationship between stock prices and

Q65: What are some of the important prerequisites

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents