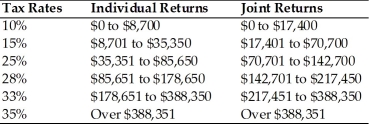

Table 1.4

Use the following tax rates and income brackets for 2012 to answer the following question(s) .

-Andrew and Jennifer are in the 25% marginal tax bracket. Three years ago they purchased 100 shares of stock at $20 a share. In 2012, they sold the 100 shares for $29 a share. What is the amount of federal income tax they owe as a result of this sale?

A) $135

B) $165

C) $225

D) $435

Correct Answer:

Verified

Q42: Table 1.4

Use the following tax rates and

Q46: Which of the following represent investment goals?

I.

Q47: Sarah purchased a stock one year ago

Q47: Investors seeking to increase their wealth as

Q49: Both the holding period to qualify and

Q52: Retirement plans, such as a 401(k), allow

Q55: Tax planning

A) guides investment activities to maximize

Q56: Speculative and growth oriented investments are least

Q59: You should spend money on housing, clothing

Q62: Discuss the relationship between stock prices and

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents