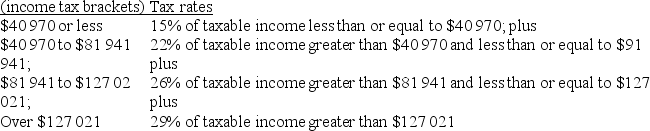

Use the 2010 federal income tax brackets and rates listed below to answer the following question.

Taxable Income

In early 2010, Juan's gross pay increased from $35 000 per year to $43 000 per year.

In early 2010, Juan's gross pay increased from $35 000 per year to $43 000 per year.

a) What was the annual percent increase in Juan's pay before federal income taxes?

b) What was the annual percent increase in Juan's pay after federal income taxes were deducted?

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q135: Use Table 3.2 on page 120 of

Q136: How many Canadian dollars can you buy

Q137: If one Canadian dollar is equivalent to

Q138: 21 is what percent of 200?

A) 0.00105%

B)

Q139: What is the price of gasoline per

Q141: Using the Table 3.2 on page 120

Q142: Use the income tax table (Table 3.3

Q143: Lakeridge Health Oshawa is a 423 beds

Q144: Your earnings of $967.34 for the week

Q145: Franco, Maria and Gomez entered into a

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents