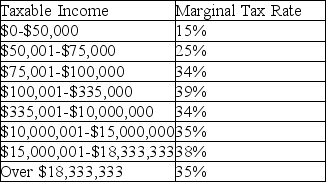

2015 U.S. Corporate tax rates are shown below:  Bouffard Co. has earnings before taxes of $100,000,000 in 2015. The company's tax expense will be

Bouffard Co. has earnings before taxes of $100,000,000 in 2015. The company's tax expense will be

A) $3,500,000.

B) $36,500,000.

C) $31,875,000.

D) $35,000,000.

Correct Answer:

Verified

Q50: Which of the following would NOT be

Q51: The highest marginal corporate tax rate is

Q52: Your firm has the following balance sheet

Q53: Which of the following would NOT be

Q54: Your firm has the following balance sheet

Q56: The most important tax rates. for financial

Q57: From the scrambled list of items presented

Q58: A corporation's average tax rate will always

Q59: Goodwin Enterprises had a gross profit of

Q60: 2015 U.S. Corporate tax rates are shown

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents