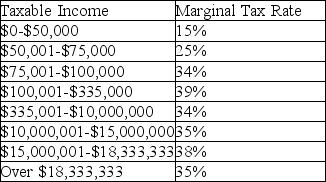

Pearls, Inc. had sales in 2015 of $2.1 million. The common stockholders received $600,000 in cash dividends. Interest totaling $150,000 was paid on outstanding debts. Operating expenses totaled $300,000, and cost of goods sold was $500,000. What is the tax liability of Pearls, Inc.? 2013 U.S. Corporate tax rates are shown below:

Correct Answer:

Verified

Sales $2,100,000

L...

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q41: Net plant and equipment is

A) plant and

Q42: A & K Co. expects to have

Q43: Which of the following best describes a

Q44: A & K Co. expects to have

Q45: Which of the following is NOT a

Q47: The marginal tax rate would equal the

Q48: The interest payments on corporate bonds are

Q49: When analyzing the cash flows from a

Q50: Which of the following would NOT be

Q51: The highest marginal corporate tax rate is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents