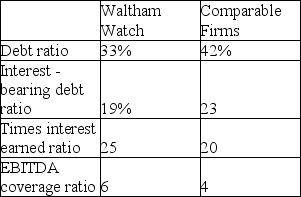

From the table above we can conclude

From the table above we can conclude

A) Waltham has a conservative capital structure policies.

B) Waltham has too much debt.

C) Waltham uses more leverage than the typical firm in its industry.

D) Waltham's EPS would be more sensitive than a typical firm's to changes in EBIT.

Correct Answer:

Verified

Q94: Farar, Inc. projects operating income of $4

Q95: The EBIT-EPS indifference point

A) identifies the EBIT

Q96: Basic tools of capital structure management include

A)

Q97: An increase in the _ is likely

Q98: Abbot Corp has a debt ratio (debt

Q100: Zybeck Corp. projects operating income of $4

Q101: On balance sheets, long-term capital leases are

Q102: When equipment is acquired under a capital

Q103: The indifference level of EBIT is

A) $99,000.

B)

Q104: Allston-Brighton Corp. has total assets of $10

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents