Allocating activity cost pools to products

Laughton Corporation makes two styles of cases for compact disks,the standard case and the deluxe case.The company has assigned $210,000 in monthly manufacturing overhead to three cost pools as follows: $90,000 to machining costs,$60,000 to production set-up costs,and $60,000 to inspection costs.

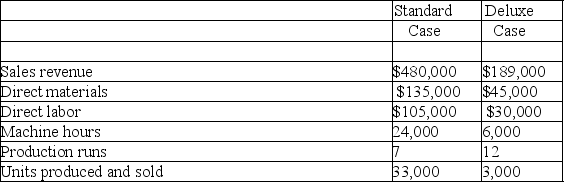

Additional monthly data are provided below:

The first and last unit in each production run is inspected for quality control purposes.Inspection costs are allocated to the products based on the number of inspections required.Machining costs are allocated to products using machine hours as an activity base.Set-up costs are allocated to products based on the number of production runs each product line requires.

The first and last unit in each production run is inspected for quality control purposes.Inspection costs are allocated to the products based on the number of inspections required.Machining costs are allocated to products using machine hours as an activity base.Set-up costs are allocated to products based on the number of production runs each product line requires.

(a)Allocate manufacturing overhead from the activity cost pools to each product line.

(b)Compare the total per-unit cost of manufacturing standard cases and deluxe cases.

(c)On a per-unit basis,which product appears to be more profitable?

Correct Answer:

Verified

Q93: Objectives of a cost accounting system

What are

Q94: Application of overhead - missing information

Holden Corporation

Q95: Job order cost system

Continental Company uses a

Q96: [The following information applies to the questions

Q97: Overhead application

For a single product manufacturing company,all

Q98: Job order cost system

Century Pools designs and

Q99: Application of overhead

Pyramid Corporation manufactures a single

Q100: Which of the following would likely be

Q101: Selecting an activity base

Listed below are six

Q103: Allocating activity cost pools to products

Burgandy Corporation

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents