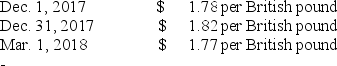

Exact Instruments sold equipment to a British research group at a price of 70,000 British pounds on December 1,2017 with payment due in 90 days.Using the following exchange rates,what gain or loss from currency fluctuations should be recognized in 2017 and 2018,respectively?

A) A $2,800 loss in 2017 and a $3,500 gain in 2018.

B) No gain or loss in 2017 and a $700 loss in 2018.

C) A $2,800 gain in 2017 and a $3,500 loss in 2018.

D) No gain or loss in 2017 and a $700 gain in 2018.

Correct Answer:

Verified

Q53: Barter Corp.sold American telecommunications equipment to a

Q54: Which of the following is true about

Q55: Hayden,Inc.purchased knobs from a Greek company for

Q56: [The following information applies to the questions

Q57: If the exchange rate for a foreign

Q59: "Adoption" means abandoning a country's financial reporting

Q60: At the current exchange rate of $1.40

Q61: Blue Waters is an American company that

Q62: Assume the exchange rate for the Mexican

Q63: Samson Corporation buys a foreign currency future

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents