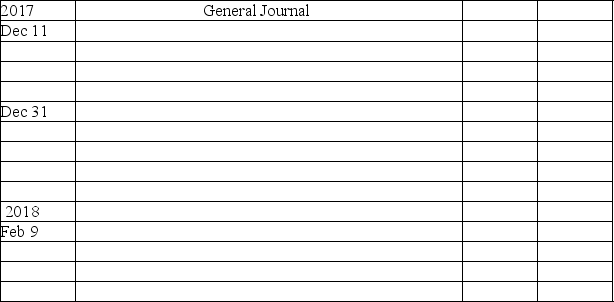

Importing Transactions-Journal Entries Striking Furs Imports Furs from Canada.In the Space Provided Below,prepare

Importing transactions-journal entries

Striking Furs imports furs from Canada.In the space provided below,prepare journal entries to record the following events.

Dec.11,2017: Purchased furs from Capable Trappers,Ltd. ,a Canadian corporation,at a price of 25,000 Canadian dollars,due in 60 days.The current exchange rate is $0.85 U.S.dollars per Canadian dollar.(Striking uses the perpetual inventory method;debit the Inventory account. )

Dec.31,2017: Striking made a year-end adjusting entry relating to the account payable to Capable Trappers.The exchange rate at year-end is $0.89 U.S.dollars per Canadian dollar.

Feb.9,2018: Issued a check for $21,750 (U.S.dollars)to National Bank in full settlement of the liability to Capable Trappers,Ltd.The exchange rate at this date is $0.87 U.S.dollars per Canadian dollar.

Correct Answer:

Verified

Q70: Trente Switch and Signal sold equipment to

Q71: Accounting terminology

Listed below are nine technical accounting

Q72: A corporation that uses a strategy of

Q73: Listed below are several terms and statements

Q74: Of the following globalization strategies,which would be

Q76: The Foreign Corrupt Practices Act (FCPA)imposes _

Q77: Exchange rates and hedging

On October 1 2018,Glenn

Q78: Which of the following does not affect

Q79: Assume the exchange rate for the Canadian

Q80: Prepare journal entries for the following transactions

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents