Fully amortizing installment note payable

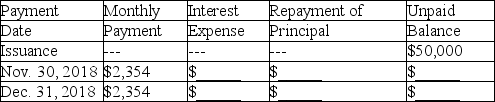

On October 31,2018 Ronald signed a 2-year installment note in the amount of $50,000 in conjunction with the purchase of equipment.This note is payable in equal monthly installments of $2,354,which include interest computed at an annual rate of 12%.The first monthly payment is made on November 30,2018.This note is fully amortizing over 24 months.

Complete the amortization table for the first two payments by entering the correct dollar amounts in the blank spaces provided.In addition,answer the questions that follow.

(a)With respect to this note,Ronald's 2018 income statement includes interest expense of $________,and Ronald's balance sheet at December 31,2018,includes a total liability for this note payable of ________.(Do not separate into current and long-term portions. )

(a)With respect to this note,Ronald's 2018 income statement includes interest expense of $________,and Ronald's balance sheet at December 31,2018,includes a total liability for this note payable of ________.(Do not separate into current and long-term portions. )

(b)The aggregate monthly cash payments Ronald will make over the 2-year life of the note payable amount to $________.

(c)Over the 2-year life of the note,the amount Ronald will pay for interest amounts to $________.

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q185: Bonds issued at par - basic concepts

On

Q186: On March 1,2018,five-year bonds are sold for

Q187: Bonds payable-issued between interest dates

Barney Corporation received

Q188: Effects of transactions upon financial measurements

Five events

Q189: Accounting terminology

Listed below are nine technical accounting

Q191: The LBB Company recently took a mortgage

Q192: Operating and capital leases

Berkeley Corporation wants to

Q193: Payroll-related expenses

Shown below is a summary of

Q194: Bond prices after issuance

Several years ago,Clear-Air Systems

Q195: Deferred income taxes

At the end of its

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents