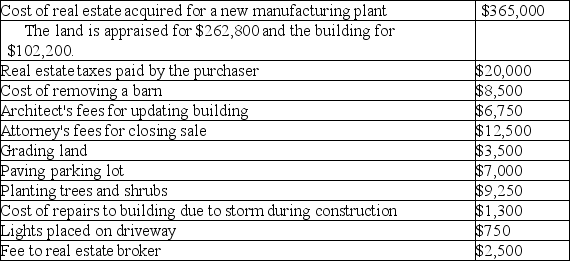

The following expenditures are related to land,land improvements,and buildings,which were acquired on November 1,2018.

Required:

Required:

Determine the cost of the land,the building and the improvements (Round to the nearest dollar)

Prepare journal entries on December 31,2018 for depreciation assuming the building will have a useful life of 20 years and no residual value.Use double declining balance method and the half-year convention.Depreciate the land improvements using straight-line method,a 5-year life,to the nearest month with zero residual value (to the nearest dollar).

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q118: Expenditures for research and development intended to

Q119: The legal life of most patents is:

A)5

Q120: All of the following may be considered

Q121: Accounting terminology

Listed below are nine technical accounting

Q122: Prepare journal entries for the following:

Q124: In February 2018,Brilliant Industries purchased the Topaz

Q125: Briefly explain the difference between a revenue

Q126: Effects of depreciation on income and cash

Q127: Early in the current year,Amazon Co.purchased the

Q128: Wanda Company sold an asset for $10,000

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents