Depreciation;gains and losses in financial statements

In 2016,Amalfi,Inc.purchased equipment with an estimated 10-year life for $42,600.The residual value was estimated at $9,900.Amalfi uses straight-line depreciation and applies the half-year convention.

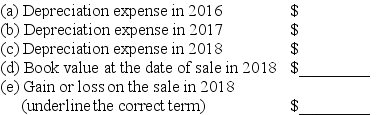

On April 18,2018,Amalfi closed one of its plants and sold this equipment for $33,600.Under these assumptions,compute the following for this equipment:

Correct Answer:

Verified

Q127: Early in the current year,Amazon Co.purchased the

Q128: Wanda Company sold an asset for $10,000

Q129: Depreciation and disposal-a comprehensive problem

Domino,Inc uses straight-line

Q130: Depreciation in financial statements

Dynasty Co.uses straight-line depreciation

Q131: Wilbur Company purchased $10,000 of equipment on

Q133: Various depreciation methods-two years

On September 6,2017,East River

Q134: Wilbur Company purchased $10,000 of equipment on

Q135: Determining cost of plant assets

New equipment was

Q136: Total stockholders' equity of Tucker Company is

Q137: Declining balance depreciation

On July 6,2017,Grayson purchased new

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents