Bank reconciliation

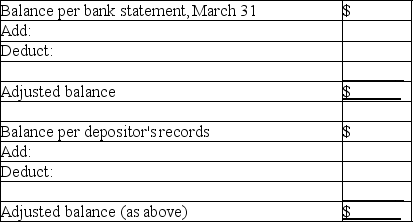

At March 31,the balance of the Cash account according to the records of Fisher Company was $7,261.The March 31 bank statement showed a balance of $8,798.You are to prepare the bank reconciliation of Fisher Company at March 31,using the following supplementary information and as per the given format:

(a. )Deposit in transit at March 31,$6,772.

(b. )Outstanding checks: no.120,$140;no.121,$932;no.127,$307;no.134,$2,200.

(c. )Service charge by bank,$50.

(d. )A note receivable for $5,050 left by Fisher Company with bank for collection that had been collected and credited to company's account.No interest involved.

(e. )A check for $90 drawn by a customer,Stuart Sands,but deducted from Fisher's account by the bank and returned with the notation "NSF."

(f. )Fisher's check no.480,issued in payment of $970 worth of office equipment,correctly written in the amount of $970 but erroneously recorded in Fisher's accounting records as $790.

Correct Answer:

Verified

Q188: Internal control over cash transactions

Listed below are

Q189: Internal control over cash transactions

(a. )Describe two

Q190: Cash management

(a. )What is meant by the

Q191: Financial assets-effects of transactions

Five events involving financial

Q192: Match the following terms with the explanations

Q194: Marketable securities

(a. )Explain how investments in available

Q195: Uncollectible accounts-two methods

At the end of the

Q196: Uncollectible accounts

(a. )What is an uncollectible account?

Q197: Balance sheet method-journal entries

The general ledger controlling

Q198: Bank reconciliation-computations and journal entry

The Cash account

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents