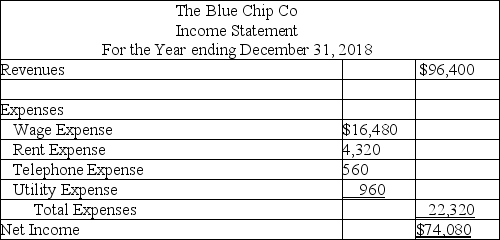

The Blue Chip Co.prepared the following income statement for December 31,2018 but neglected to make the necessary adjusting entries.

Required: Prepare a corrected income statement after considering the following:

Required: Prepare a corrected income statement after considering the following:

(1. )The company had purchased a truck for $4,800 on January 1,2018 that was expected to last 5 years.It was originally debited to the account "Truck" and credited to cash.

(2. )Salaries of $2,400 were owed to employees but not yet recorded.

(3. )The company owed $640 in accrued interest that was to be paid early in January 2019.

(4. )In November 2018,the company had received $3,600 of advance payments,which were originally recorded as Unearned Revenue.One-third of this was earned in December 2018.

Correct Answer:

Verified

Q116: The accountant for Perfect Painting forgot the

Q117: Before any month-end adjustments are made,the net

Q118: Before any month-end adjustments are made,the net

Q119: The concept of materiality:

A)Involves only tangible assets

Q120: Which of the following accounting principles is

Q122: End-of-period adjustments

West Laboratory adjusts and closes its

Q123: Murphy's Auto Co.purchased a large piece of

Q124: Adjusting entries

Selected ledger accounts used by Cross

Q125: Accounting terminology

Listed below are nine technical accounting

Q126: Adjusting entries-effect on elements of financial statements

Galaxy

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents