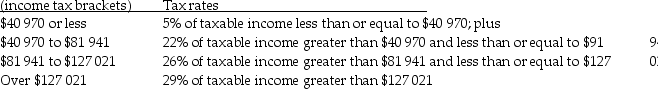

Use the 2010 federal income tax brackets and rates listed below to answer the following question.

Taxable Income

a)Sean had a taxable income of $42 500 in 2011.How much federal income tax should he report? (assuming tax rates remain the same)

a)Sean had a taxable income of $42 500 in 2011.How much federal income tax should he report? (assuming tax rates remain the same)

b)Sean expects his taxable income to increase by 150% in 2012.How much federal tax would he expect to pay in 2012(assuming tax rates remain the same).

Correct Answer:

Verified

View Answer

Unlock this answer now

Get Access to more Verified Answers free of charge

Q122: How much is $18.00 increased by 250%?

A)

Q122: A law firm has 3 partners.The first

Q123: Use the 2010 federal income tax brackets

Q124: $165.00 is what percentage less than $247.50?

A)66

Q124: Betty calculated her 2011 taxable income to

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents