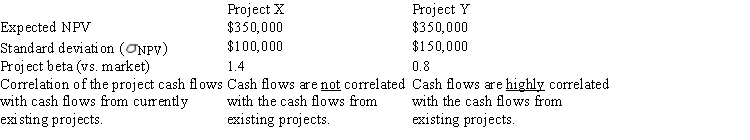

Taussig Technologies is considering two potential projects,X and Y.In assessing the projects' risks,the company estimated the beta of each project versus both the company's other assets and the stock market,and it also conducted thorough scenario and simulation analyses.This research produced the following data: Project X

Project Y

Expected NPV

$350,000

$350,000

Standard deviation (  NPV)

NPV)  $100,000

$100,000

$150,000

Project beta (vs.market)

1) 4

0) 8

Correlation of the project cash flows with cash flows from currently existing projects.

Cash flows are not correlated with the cash flows from existing projects.

Cash flows are highly correlated with the cash flows from existing projects.

Which of the following statements is CORRECT?

A) Project X has more stand-alone risk than Project Y.

B) Project X has more corporate (or within-firm) risk than Project Y.

C) Project X has more market risk than Project Y.

D) Project X has the same level of corporate risk as Project Y.

E) Project X has the same market risk as Project Y since its cash flows are not correlated with the cash flows of existing projects.

Correct Answer:

Verified

Q41: Currently,Powell Products has a beta of 1.0,and

Q46: Which of the following statements is CORRECT?

A)

Q48: Which of the following statements is CORRECT?

A)

Q49: Which of the following rules is CORRECT

Q51: Which of the following procedures does the

Q54: Which of the following statements is CORRECT?

A)

Q55: Which of the following statements is CORRECT?

A)

Q57: Which one of the following would NOT

Q57: As assistant to the CFO of Boulder

Q59: Which of the following should be considered

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents