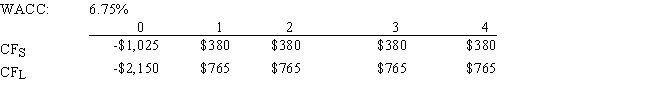

A firm is considering Projects S and L,whose cash flows are shown below.These projects are mutually exclusive,equally risky,and not repeatable.The CEO wants to use the IRR criterion,while the CFO favors the NPV method.You were hired to advise the firm on the best procedure.If the wrong decision criterion is used,how much potential value would the firm lose?

A) $214.44

B) $186.47

C) $218.17

D) $182.74

E) $220.03

Correct Answer:

Verified

Q97: Maxwell Feed & Seed is considering a

Q98: Ehrmann Data Systems is considering a project

Q99: Resnick Inc.is considering a project that has

Q100: Susmel Inc.is considering a project that has

Q101: Nast Inc.is considering Projects S and L,whose

Q102: Moerdyk & Co.is considering Projects S and

Q103: Kosovski Company is considering Projects S and

Q104: Yonan Inc.is considering Projects S and L,whose

Q106: Sexton Inc.is considering Projects S and L,whose

Q107: Noe Drilling Inc.is considering Projects S and

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents