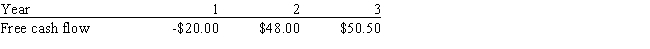

Wall Inc.forecasts that it will have the free cash flows (in millions) shown below.If the weighted average cost of capital is 14% and the free cash flows are expected to continue growing at the same rate after Year 3 as from Year 2 to Year 3,what is the firm's total corporate value,in millions?

A) $535.20

B) $553.65

C) $572.11

D) $549.04

E) $461.38

Correct Answer:

Verified

Q71: Carter's preferred stock pays a dividend of

Q80: Kedia Inc.forecasts a negative free cash flow

Q81: Nachman Industries just paid a dividend of

Q82: Church Inc.is presently enjoying relatively high growth

Q83: Ackert Company's last dividend was $4.00.The dividend

Q85: Your boss,Sally Maloney,treasurer of Fred Clark Enterprises

Q86: Savickas Petroleum's stock has a required return

Q87: The Ramirez Company's last dividend was $1.75.Its

Q88: Agarwal Technologies was founded 10 years ago.It

Q89: Huang Company's last dividend was $1.25.The dividend

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents