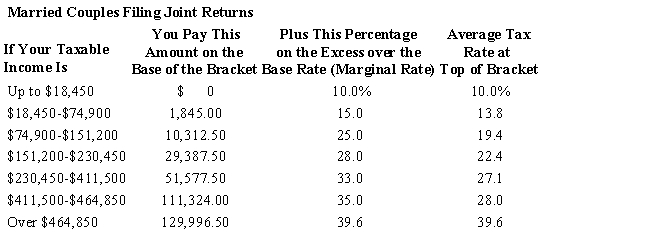

Alan and Sara Winthrop are a married couple who file a joint income tax return.They have two children,so they claim a total of 4 exemptions.In addition,they have legitimate itemized deductions totaling $25,750.Their total income from wages is $237,500.Assume the following tax table is applicable:

What is their federal tax liability?

A) $29,387.50

B) $31,875.25

C) $35,345.50

D) $40,525.00

E) $41,861.50

Correct Answer:

Verified

Q128: Maureen Smith is a single individual.She claims

Q129: Maureen Smith is a single individual.She claims

Q130: Last year,Martyn Company had $260,000 in taxable

Q131: Alan and Sara Winthrop are a married

Q132: Alan and Sara Winthrop are a married

Q134: Maureen Smith is a single individual.She claims

Q135: Lintner Beverage Corp.reported the following information from

Q136: Bradshaw Beverages began operations in 2011.The table

Q137: Collins Co.began operations in 2012.The company lost

Q138: Maureen Smith is a single individual.She claims

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents