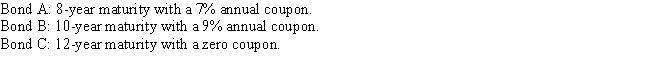

Consider each of the following bonds:  Each bond has a face value of $1,000 and a yield to maturity of 8%.Which of the following statements is NOT correct?

Each bond has a face value of $1,000 and a yield to maturity of 8%.Which of the following statements is NOT correct?

A) Bond A sells at a discount,while Bond B sells at a premium.

B) If the yield to maturity on each bond falls to 7%,Bond C will have the largest percentage increase in its price.

C) Bond C has the most reinvestment risk.

D) Bond C has the most price risk.

E) If the yield to maturity is constant,the price of Bond A will continue to increase over its life until it finally sells at par.

Correct Answer:

Verified

Q5: Which of the following statements is CORRECT?

A)If

Q8: Refer to Exhibit 7A.1.What is the nominal

Q9: A 2-year,zero coupon Treasury bond with a

Q10: McGwire Company's pension fund projects that most

Q11: You just purchased a 12-year,$1,000 face value,zero

Q12: Vogril Company issued 20-year,zero coupon bonds with

Q15: Recycler Battery Corporation (RBC)issued zero coupon bonds

Q16: A 14-year,$1,000 face value,zero coupon bond has

Q17: Assume that the City of Tampa sold

Q18: A 4-year,zero coupon Treasury bond sells at

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents