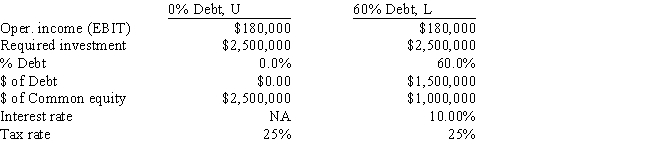

You work for the CEO of a new company that plans to manufacture and sell a new product,a watch that has an embedded TV set and a magnifying glass crystal.The issue now is how to finance the company,with only equity or with a mix of debt and equity.Expected operating income is $180,000.The company is small,so it is not subject to the interest deduction limitation.Other data for the firm are shown below.How much higher or lower will the firm's expected ROE be if it uses some debt rather than all equity,i.e. ,what is ROEL - ROEU? Do not round your intermediate calculations.

A) -3.78%

B) -3.15%

C) -2.84%

D) -4.10%

E) -3.31%

Correct Answer:

Verified

Q41: Other things held constant,which of the following

Q43: Your firm is currently 100% equity financed.The

Q45: Which of the following statements is CORRECT?

A)

Q54: Companies HD and LD have identical amounts

Q57: Which of the following statements is CORRECT?

A)

Q63: As a consultant to First Responder Inc.

Q64: Your uncle is considering investing in a

Q65: Firm A is very aggressive in its

Q66: Southwest U's campus book store sells course

Q78: Which of the following statements is CORRECT?

A)

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents