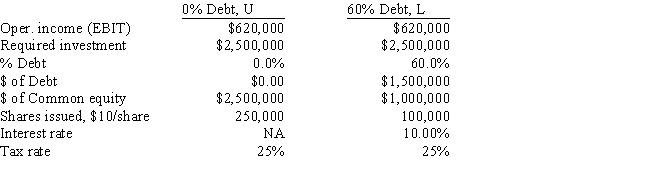

You work for the CEO of a new company that plans to manufacture and sell a new type of laptop computer.The issue now is how to finance the company,with only equity or with a mix of debt and equity.Expected operating income is $620,000.Other data for the firm are shown below.How much higher or lower will the firm's expected EPS be if it uses some debt rather than only equity,i.e. ,what is EPSL - EPSU?

A) $1.50

B) $2.08

C) $1.91

D) $1.67

E) $1.58

Correct Answer:

Verified

Q74: You plan to invest in one of

Q75: Senate Inc.is considering two alternative methods for

Q76: El Capitan Foods has a capital structure

Q77: Southwest U's campus book store sells course

Q77: Which of the following statements is CORRECT?

A)

Q79: Longstreet Inc.has fixed operating costs of $670,000,variable

Q80: Gator Fabrics Inc.currently has zero debt .It

Q81: Dyson Inc.currently finances with 20.0% debt (i.e.

Q82: Your girlfriend plans to start a new

Q83: Your firm's debt ratio is only 5.00%,but

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents