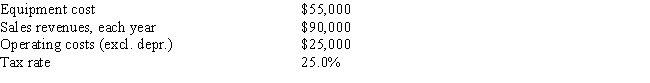

Fool Proof Software is considering a new project whose data are shown below.The equipment that would be used has a 3-year tax life.Under the new tax law,the equipment used in the project is eligible for 100% bonus depreciation,so it will be fully depreciated at t = 0.Revenues and operating costs are expected to be constant over the project's 10-year expected life.What is the Year 1 cash flow?

A) $33,177

B) $22,409

C) $48,750

D) $26,483

E) $22,991

Correct Answer:

Verified

Q41: Currently,Powell Products has a beta of 1.0,and

Q41: Your company,RMU Inc. ,is considering a new

Q44: Langston Labs has an overall (composite)WACC of

Q45: A company is considering a proposed new

Q45: A firm is considering a new project

Q49: Which of the following rules is CORRECT

Q51: Which of the following procedures does the

Q54: Which of the following statements is CORRECT?

A)

Q55: Which of the following statements is CORRECT?

A)

Q57: Which one of the following would NOT

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents