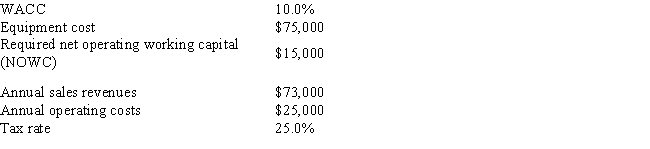

Foley Systems is considering a new project whose data are shown below.Under the new tax law,the equipment for the project is eligible for 100% bonus depreciation,so it will be fully depreciated at t = 0.After the project's 3-year life,the equipment would have zero salvage value.The project would require additional net operating working capital (NOWC) that would be recovered at the end of the project's life.Revenues and operating costs are expected to be constant over the project's life.What is the project's NPV? (Hint: Cash flows from operations are constant in Years 1 to 3. ) Do not round the intermediate calculations and round the final answer to the nearest whole number.

A) $2,549

B) $18,970

C) $4,571

D) $20,001

E) $1,348

Correct Answer:

Verified

Q48: Which of the following statements is CORRECT?

A)

Q59: Clemson Software is considering a new project

Q61: Thomson Media is considering some new equipment

Q62: Aggarwal Enterprises is considering a new project

Q63: Poulsen Industries is analyzing an average-risk project,and

Q65: Florida Car Wash is considering a new

Q66: Desai Industries is analyzing an average-risk project,and

Q67: Marshall-Miller & Company is considering the purchase

Q68: TexMex Food Company is considering a new

Q69: You work for Whittenerg Inc. ,which is

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents