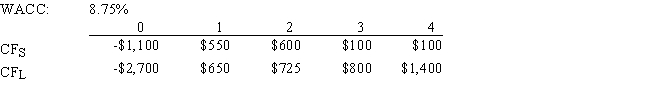

Tesar Chemicals is considering Projects S and L,whose cash flows are shown below.These projects are mutually exclusive,equally risky,and not repeatable.The CEO believes the IRR is the best selection criterion,while the CFO advocates the NPV.If the decision is made by choosing the project with the higher IRR rather than the one with the higher NPV,how much,if any,value will be forgone,i.e. ,what's the chosen NPV versus the maximum possible NPV? Note that (1) "true value" is measured by NPV,and (2) under some conditions the choice of IRR vs.NPV will have no effect on the value gained or lost.

A) $79.93

B) $70.65

C) $71.36

D) $88.49

E) $68.51

Correct Answer:

Verified

Q63: Projects S and L are equally risky,mutually

Q67: A company is choosing between two projects.The

Q75: McCall Manufacturing has a WACC of 10%.The

Q78: You are considering two mutually exclusive,equally risky,projects.Both

Q81: Maxwell Feed & Seed is considering a

Q83: Last month,Lloyd's Systems analyzed the project whose

Q84: Datta Computer Systems is considering a project

Q85: Ehrmann Data Systems is considering a project

Q86: Mansi Inc.is considering a project that has

Q87: Susmel Inc.is considering a project that has

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents