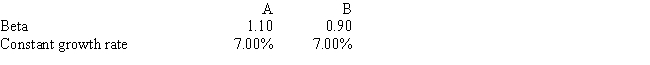

Stocks A and B have the following data.The market risk premium is 6.0% and the risk-free rate is 6.4%.Assuming the stock market is efficient and the stocks are in equilibrium,which of the following statements is CORRECT?

A) Stock A must have a higher stock price than Stock B.

B) Stock A must have a higher dividend yield than Stock B.

C) Stock B's dividend yield equals its expected dividend growth rate.

D) Stock B must have the higher required return.

E) Stock B could have the higher expected return.

Correct Answer:

Verified

Q24: Two constant growth stocks are in equilibrium,have

Q25: Companies can issue different classes of common

Q26: Stock X has the following data.Assuming the

Q29: Stocks A and B have the following

Q29: Which of the following statements is CORRECT?

A)

Q30: Stocks A and B have the same

Q32: If a stock's dividend is expected to

Q33: Stocks X and Y have the following

Q34: An increase in a firm's expected growth

Q35: Stocks X and Y have the following

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents