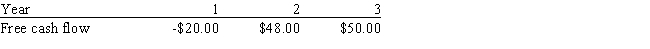

Wall Inc.forecasts that it will have the free cash flows (in millions) shown below.Assume the firm has zero non-operating assets.If the weighted average cost of capital is 14% and the free cash flows are expected to continue growing at the same rate after Year 3 as from Year 2 to Year 3,what is the firm's total corporate value,in millions? Do not round intermediate calculations.

A) $492.77

B) $349.05

C) $394.22

D) $418.86

E) $410.65

Correct Answer:

Verified

Q79: You must estimate the intrinsic value of

Q80: Carter's preferred stock pays a dividend of

Q81: Church Inc.is presently enjoying relatively high growth

Q82: Savickas Petroleum's stock has a required return

Q83: Your boss,Sally Maloney,treasurer of Fred Clark Enterprises

Q84: The Ramirez Company's last dividend was $1.75.Its

Q86: Huang Company's last dividend was $1.25.The dividend

Q87: Agarwal Technologies was founded 10 years ago.It

Q88: Ackert Company's last dividend was $3.00.The dividend

Q89: Nachman Industries just paid a dividend of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents