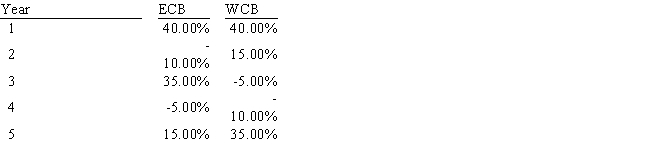

Assume that your uncle holds just one stock,East Coast Bank (ECB) ,which he thinks has very little risk.You agree that the stock is relatively safe,but you want to demonstrate that his risk would be even lower if he were more diversified.You obtain the following returns data for West Coast Bank (WCB) .Both banks have had less variability than most other stocks over the past 5 years.Measured by the standard deviation of returns,by how much would your uncle's risk have been reduced if he had held a portfolio consisting of 57% in ECB and the remainder in WCB? (Hint: Use the sample standard deviation formula. ) Do not round your intermediate calculations.

A) 3.85%

B) 4.87%

C) 3.57%

D) 3.93%

E) 3.06%

Correct Answer:

Verified

Q137: Kollo Enterprises has a beta of 1.02,the

Q138: You hold a diversified $100,000 portfolio consisting

Q139: Suppose you hold a portfolio consisting of

Q140: Company A has a beta of 0.70,while

Q141: Assume that you are the portfolio manager

Q142: Returns for the Dayton Company over the

Q143: CCC Corp has a beta of 1.5

Q145: Carson Inc.'s manager believes that economic conditions

Q146: A mutual fund manager has a $40.00

Q147: Assume that you manage a $10.00 million

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents