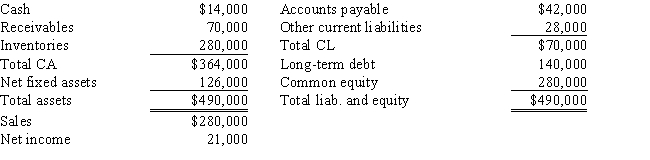

Jordan Inc has the following balance sheet and income statement data:  The new CFO thinks that inventories are excessive and could be lowered sufficiently to cause the current ratio to equal the industry average,2.70,without affecting either sales or net income.Assuming that inventories are sold off and not replaced to get the current ratio to the target level,and that the funds generated are used to buy back common stock at book value,by how much would the ROE change? Do not round your intermediate calculations.

The new CFO thinks that inventories are excessive and could be lowered sufficiently to cause the current ratio to equal the industry average,2.70,without affecting either sales or net income.Assuming that inventories are sold off and not replaced to get the current ratio to the target level,and that the funds generated are used to buy back common stock at book value,by how much would the ROE change? Do not round your intermediate calculations.

A) 15.25%

B) 13.75%

C) 11.63%

D) 13.50%

E) 12.50%

Correct Answer:

Verified

Q107: Last year Rennie Industries had sales of

Q108: Last year Hamdi Corp.had sales of $500,000,operating

Q109: Last year Ann Arbor Corp had $240,000

Q110: Duffert Industries has total assets of $1,040,000

Q111: Last year Kruse Corp had $440,000 of

Q113: Exhibit 4.1

The balance sheet and income statement

Q114: Quigley Inc.is considering two financial plans for

Q115: Last year Jandik Corp.had $270,000 of assets

Q116: Last year Blease Inc had a total

Q117: Brookman Inc's latest EPS was $2.75,its book

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents