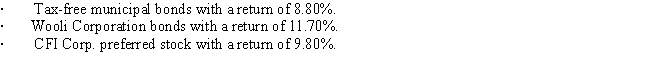

Arvo Corporation is trying to choose between three alternative investments.The three securities that the company is considering are as follows:  The company's tax rate is 25.00%.What is the after-tax return on the best investment alternative? Assume a 50.00% dividend exclusion for tax on dividends.(Round your final answer to 3 decimal places. )

The company's tax rate is 25.00%.What is the after-tax return on the best investment alternative? Assume a 50.00% dividend exclusion for tax on dividends.(Round your final answer to 3 decimal places. )

A) 8.800%

B) 10.296%

C) 9.944%

D) 7.128%

E) 8.888%

Correct Answer:

Verified

Q97: Brown Office Supplies recently reported $15,500 of

Q98: Hayes Corporation has $300 million of common

Q99: Casey Motors recently reported the following information:

Q100: Emery Mining Inc.recently reported $147,500 of sales,$75,500

Q101: Last year,Stewart-Stern Inc.reported $11,250 of sales,$4,500 of

Q103: Solarcell Corporation has $20,000 that it plans

Q104: Van Dyke Corporation has a corporate tax

Q105: For 2019,Bargain Basement Stores reported $11,500 of

Q106: In 2018,Garner Grocers had taxable income of

Q107: Mantle Corporation is considering two equally risky

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents