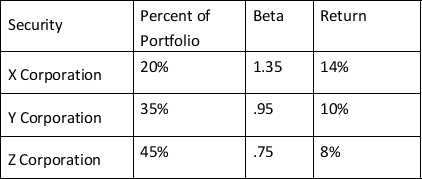

You hold a portfolio with the following securities:  Calculate the expected return and beta for the portfolio.

Calculate the expected return and beta for the portfolio.

A) 10.67%, 1.02

B) 9.9%, 1.02

C) 34.4%, .94

D) 9.9%, .94

Correct Answer:

Verified

Q38: If you hold a portfolio made up

Q39: The standard deviation of returns on Warchester

Q40: On average, when the overall market changes

Q42: Which of the following statements is true?

A)A

Q44: Shares with higher betas are usually more

Q45: Which of the following is a good

Q46: The beta of ABC Co.shares is the

Q55: Which of the following statements is true?

A)

Q59: Total risk equals unsystematic risk times systematic

Q60: The CAPM designates the risk-return tradeoff existing

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents