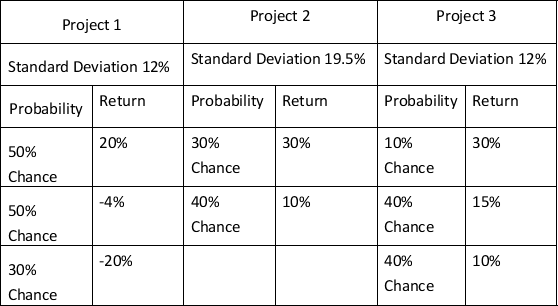

You are going to invest all of your funds in one of three projects with the following distribution of possible returns:  If you are a risk-averse investor, which one should you choose?

If you are a risk-averse investor, which one should you choose?

A) Project 1

B) Project 2

C) Project 3

D) A risk-averse investor would not choose any of these projects

Correct Answer:

Verified

Q61: The SML relates risk to return, for

Q61: The market rewards assuming additional unsystematic risk

Q63: Shares with a beta of 1.0 would

Q64: Given the capital asset pricing model, a

Q65: In 1990, Harry Markowitz and William Sharpe

Q68: Betas for individual shares tend to be

Q71: The risk-return relationship for each financial asset

Q75: Provide an intuitive discussion of beta and

Q78: The security market line (SML) relates risk

Q118: Unsystematic risk can be eliminated through diversification.

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents