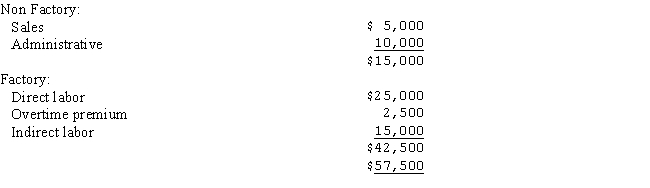

Western Industries pays employees on a weekly basis on Tuesday for the week ended the previous Friday.Employees' compensation is earned evenly each day over a 5-day work week.This year,April 30 fell on Thursday.Payroll costs for the week ended May 1 follow:  Excluding payroll taxes,how much of the accrued payroll at April 30 should be charged to Factory Overhead?

Excluding payroll taxes,how much of the accrued payroll at April 30 should be charged to Factory Overhead?

A) $17,500

B) $26,000

C) $14,000

D) $34,000

Correct Answer:

Verified

Q20: A wage plan based solely on an

Q21: Jay Vato works at Batwing Industries from

Q22: An accrued expense such as Wages Payable

Q23: Harmony Company has accrued payroll costs of

Q24: Which of the following is not true

Q26: The Fiesta Royale Corporation payroll for the

Q27: Features of a 401(k)plan include all of

Q28: John Elton,who is classified as direct labor,earns

Q29: Of the following taxes,the only one that

Q30: Joel Williams works at Allentown Company where

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents