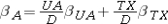

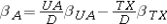

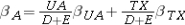

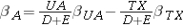

If the assets of the firm with value A as a portfolio of unlevered assets with value UA and debt tax shields with value TX,then the beta of the assets is represented by:

A)

B)

C)

D)

Correct Answer:

Verified

Q3: Distinguish the unlevered cost of capital from

Q4: The debt tax shield is:

A)the present value

Q5: Explain how NPV of projects is calculated

Q6: Explain the debt capacity of a firm.Differentiate

Q7: If a company funds a new investment

Q9: Which of the following is the correct

Q10: The adjusted present value method:

A)calculates the NPV

Q11: The unlevered cost of capital is the:

A)expected

Q12: A firm's marginal cost of capital:

A)is the

Q13: A company has a debt-to-equity ratio of

Unlock this Answer For Free Now!

View this answer and more for free by performing one of the following actions

Scan the QR code to install the App and get 2 free unlocks

Unlock quizzes for free by uploading documents